Donators to the SOPHIA Fund for the Future are eligible for Tax Benefits as follows.

Deduction for corporate tax: Applicable to corporations

Donations from corporations can be incorporated into “deductible expenses” for the relevant business year separately from the framework for general “donation expenses.”

There are two types of donations that can be incorporated into deductible expenses: (1) Specified donation (which can be incorporated into deductible expenses to a limited extent) and (2) recipient-designated donation (all of which can be incorporated into deductible expenses)

Please feel free to contact the Sophia UniversityOffice for Community & Alumni Relationswhen considering donating.

-

(1) Specified donation

Donations from corporations can be incorporated into “deductible expenses” for the relevant business year separately from the framework for general “donation expenses.”

But please be reminded that there are limits to the amount of donation according to corporate categories. As for the calculating formula, please refer to the National Tax Agency’s website page “Donations to Public Interest Incorporated Association,etc” (Japanese only)

Documents required for filing tax returns (“Receipt of Donation” issued by our School and “Certificate of Public Interest Incorporated Association, etc(copy)”) will be sent to you upon confirming receipt of your donation. -

(2) Recipient-designated donation

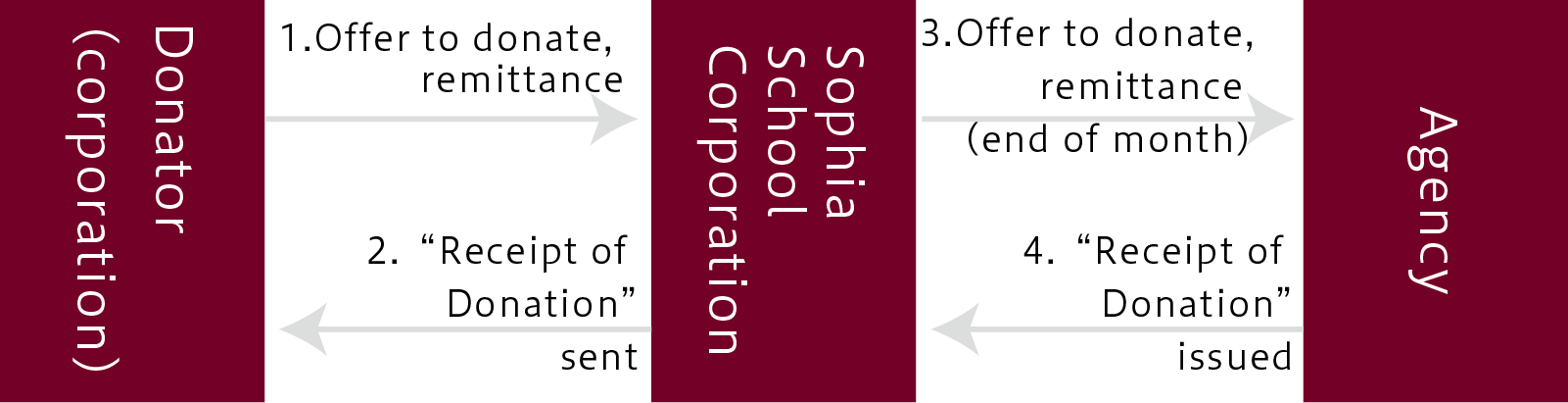

This is a system under which donations are channeled to our School (recipient) through the Promotion and Mutual Aid Corporation for Private Schools of Japan (hereinafter “the Agency”). The full amount of donations can be incorporated into deductible expenses for the relevant business year.

Infiling tax returns for this sort of donation, you are required to have a “Receipt of Donation” issued by the Agency. This “Receipt of Donation” will be sent via our School.

*In making a donation offer, you are required to submit two types of applications, one addressed to Sophia School Corporation and the other to the Agency.

*As donations received by our School are remitted to the Agency every time we close our donation books at month-end, it will take a month or one month and a half for the Agency to issue a “Receipt of Donation.” Please consult us when you are in a hurry to close the books and for other purposes.Please visit the Agency’s website page dedicated to recipient-designated donations (in Japanese).

(2) Tax deduction scheme

You can deduct donations from income tax for the year of contribution based on the following calculating formula.

(Total sum of annual donations* minus 2,000 yen) x 40% = Amount of deduction from income tax**

** Limited to maximum 25% of income tax

About procedures

Please file income tax returns with a competent tax office in the year after your donation.

In filing tax returns, the following documents become necessary.“Transfer Payment Bill-cum-Receipt” received at the time of transferring your donation from an account at a financial institution represents a “Receipt of Donation” and so please lay it up in lavender.

The following certificates (copies) will be sent to you upon confirming receipt of your donation.

(1) For income deduction: “Receipt of Donation” and “Certificate of Public Interest Incorporated Association, etc(copy)”

(2) For income tax deduction: “Receipt of Donation” and “Certificate Associated with Income Tax Deduction (copy)”

* In the event of two or more donations made in the same year, you are required to obtain a “Receipt of Donation” each time but you need only one certificate (copy) sent at the time of your first donation in order to file an income tax return.

*In filing tax returns, you are recommended to use the National Tax Agency’s website. An English manual on “How to create a final tax return for office workers” is available here: 061.pdf (nta.go.jp)

*Please contact your competent tax office to seek advice on filing tax returns.