Donation of inherited assets

We would like to accept both a donation to our School by will of part of property amassed by the donator based on the donator’s desire (“donation by will”)) or a donation to the School of part of inherited assets on the basis of the bereaved family’s desire (“donation of inherited property”)) in accordance with the donator’s intention of appropriation to expenses for education and research activities. Donations are eligible for Tax Benefits.

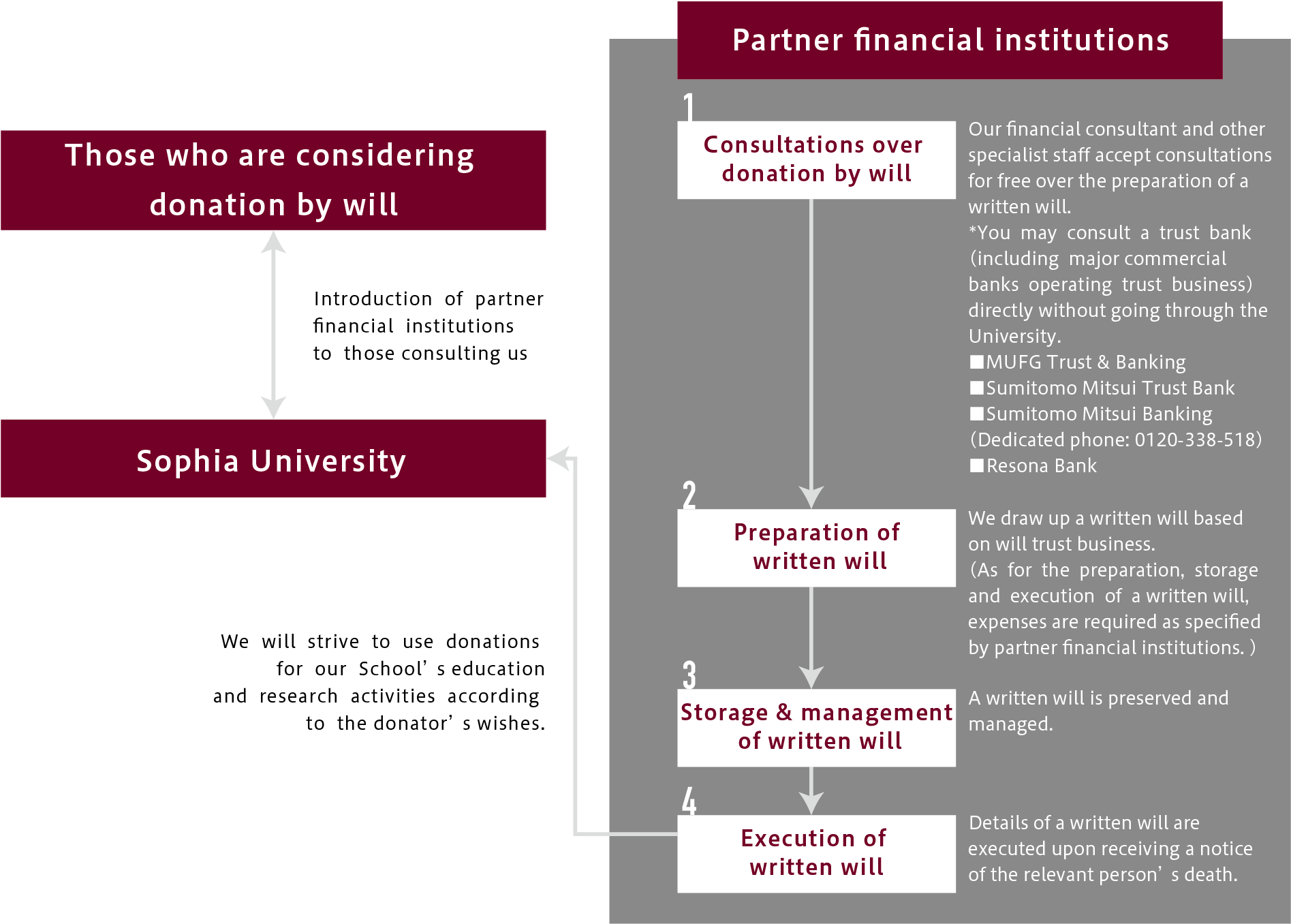

The School’s partner financial institutions will undertake complicated inheritance procedures, etc., ranging from the listing of property to be inherited to the division of inheritance, on behalf of donators. We would appreciate if you could consider donations as one of your contributions to society through university as well as one of tax-saving measures.

Donation by will

Donation of inherited property

Part of inherited property can be donated to our School by the will of the deceased and wishes of the bereaved family.

No inheritance tax is imposed in principle when a monetary donation is made by the deadline for submitting an inheritance tax declaration (within 10 months from the day after the relevant person’s death).

Please be reminded that it takes a certain amountof days to issue a tax exemption certificate.